Machine learning is revolutionizing payment platforms, and Stripe stands at the forefront of this innovation. By leveraging advanced algorithms, Stripe enhances fraud detection, optimizes transaction processing, and personalizes user experiences. This powerful integration ensures seamless operations for businesses while fostering trust and security. Explore how Stripe uses machine learning to elevate digital payments to new heights.

Why Machine Learning Matters for Payment Systems

Technological progress is generating a significant shift towards digital transactions, which consumers increasingly prefer due to their fast and convenient nature. Businesses must adapt to this trend, as customers are attracted to the swift and convenient online payment methods available today. However, the growing number of digital payments also presents an increasing challenge of fraud.

Machine learning algorithms analyze extensive data patterns to detect suspicious activities effectively. With continuous learning capabilities, machine learning helps maintain an advantage against fraudsters, thereby reducing fraudulent transactions.

Stripe’s Practical Applications of Machine Learning

Stripe’s use of machine learning goes beyond theoretical algorithms to address real-world business challenges. Here’s how they’re using ML to innovate the payments industry:

1. Fraud Detection and Prevention with Radar

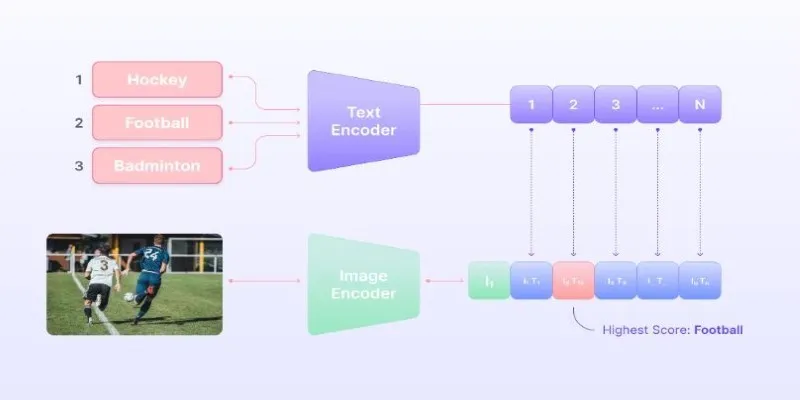

Fraud is a significant concern for businesses, and payment gateways like Stripe are on the frontlines. To combat this, Stripe developed Radar , a robust ML-powered fraud prevention tool. Radar analyzes millions of transactions daily to detect suspicious activities and block fraud in real- time.

Key Features of Radar:

- Behavioral Analysis : Uses transaction patterns, geolocation, and device data to identify anomalous behavior.

- Risk-Score Models : Assigns risk scores to transactions, flagging high-risk payments for review.

- Custom Rules : Businesses can add custom rule sets tailored to their operational needs.

2. Optimizing Payment Acceptance with Adaptive Acceptance

For businesses, every payment failure or decline results in lost revenue and dissatisfied customers. Stripe’s Adaptive Acceptance employs machine learning to maximize the likelihood of payment approval.

Here’s how it works:

- When a transaction is declined, Adaptive Acceptance intelligently retries the payment using optimized routing paths and tailored retry logic.

- Payment data is continuously analyzed to identify factors affecting approval rates, allowing Stripe to refine its approaches over time.

The impact of increased payment acceptance rates is clear: more conversions and happier customers.

3. Streamlined Global Compliance with AI

Expanding a business internationally involves navigating a maze of tax codes, regulations, and payment requirements unique to each country. Stripe employs ML models to simplify global compliance:

- Automatic Tax Calculations : Stripe Tax uses ML algorithms to identify tax obligations across jurisdictions and instantly calculate the correct rates.

- Localized Payment Methods : Stripe’s ML models analyze regional payment trends, offering businesses the most relevant methods to increase conversions in new markets.

This approach makes global expansion less daunting and more seamless for businesses of all sizes.

4. Advanced Insights with Sigma

Machine learning isn’t just about automation; it’s also about generating insights. Stripe’s Sigma is an analytics and reporting tool powered by machine learning that enables businesses to deeply understand their payment data.

With Sigma, businesses can:

- Track key metrics like revenue growth, churn rates, and recurring payment success rates.

- Use SQL-based queries to generate customized reports, uncover trends, and make more informed decisions.

Businesses no longer need complex third-party integrations, as they get actionable insights directly within Stripe’s ecosystem.

Why Stripe’s Approach to ML Stands Out

Stripe’s approach to machine learning makes it an industry leader. Here’s why:

1. Data at Scale

Stripe processes billions of dollars in payments annually, providing massive datasets for training ML models. This scale enhances the accuracy and effectiveness of their algorithms.

2. Focus on Developer Empowerment

Stripe integrates advanced ML tools into its APIs, empowering developers to implement these capabilities effortlessly. This democratization ensures businesses of all sizes can benefit from ML-powered insights and tools.

3. Continuous Learning

Stripe’s ML models are not static. They continuously learn and adapt based on new data, making them more effective over time. For example, Radar’s fraud- detection capabilities improve with every transaction it processes.

Business Benefits of Stripe’s Machine Learning

For businesses leveraging Stripe’s ML tools, the benefits are undeniable:

- Improved Revenue : Higher payment acceptance rates and reduced fraud losses directly contribute to better revenue outcomes.

- Enhanced Customer Experience : Seamless, reliable payments build trust and satisfaction among customers.

- Cost Savings : Automation reduces operational costs associated with manual reviews and compliance management.

- Strategic Insights : Advanced analytics enable smarter, data-driven decision-making.

By handling the complexities of payments with ML, Stripe empowers businesses to focus on their core operations and growth.

What Other Businesses Can Learn

Stripe’s success with machine learning highlights critical lessons for businesses looking to incorporate AI into their workflows:

- Start Small, Scale Smart : Begin with use cases that offer immediate value, such as automating repetitive tasks or improving fraud detection, and scale as the tools prove their worth.

- Leverage Existing Expertise : Partnering with companies like Stripe or adopting ready-built ML frameworks can speed up implementation and ROI.

- Prioritize Ethical AI : Machine learning must be used responsibly. Stripe ensures data privacy and adherence to compliance guidelines across all regions.

- Commit to Continuous Improvement : AI models should evolve with new data to remain effective. Businesses must prioritize updating and training these systems regularly.

Future of Machine Learning in Payments

The future of machine learning in payments is set to revolutionize the industry further. Advancements in AI-driven models will enable faster and more secure transactions, enhancing the overall customer experience. Predictive analytics will play a pivotal role in identifying payment trends, empowering businesses to adapt quickly to shifting consumer behaviors.

As machine learning advances, fraud detection systems will become more sophisticated. Real-time analysis will allow potential threats to be identified and mitigated instantly, increasing trust in digital payment systems. This innovation will not only protect businesses but also provide consumers with peace of mind.

Conclusion

Stripe’s integration of machine learning into its platform demonstrates its commitment to driving innovation beyond the hype. By leveraging cutting-edge algorithms, Stripe empowers businesses to create seamless and secure payment experiences tailored to their customers’ needs. From optimizing payment success rates to enhancing fraud prevention, machine learning is at the core of Stripe’s ability to transform complex challenges into intuitive solutions.

zfn9

zfn9