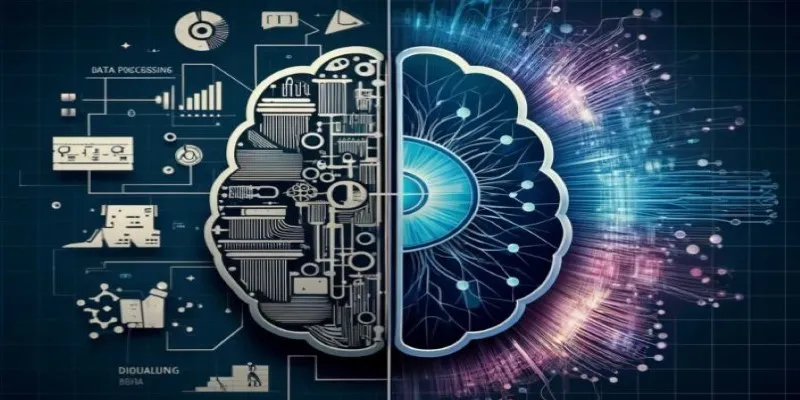

Artificial intelligence (AI) has evolved beyond basic automation, now playing a pivotal role in generating content, data, and financial insights. This evolution has ushered in the era of generative AI, a cutting-edge technology capable of creating new materials from existing data, closely mimicking human creativity. Unlike traditional AI, which primarily predicts outcomes, generative AI produces original text, images, and models, significantly impacting industries such as finance, healthcare, and media.

In the financial sector, generative AI automates report generation, enhances market predictions, and optimizes investment strategies. Businesses are increasingly leveraging AI-driven automation to refine decision-making and boost efficiency. As generative AI continues to advance, its potential to reshape financial processes and business operations positions it as a transformative force in modern industries.

What Is Generative AI?

Generative AI is a branch of artificial intelligence focused on the creation of new data rather than merely analyzing existing information. It leverages deep learning techniques, including neural networks, enabling machines to generate human-like text, images, music, and even complex financial models. Unlike rule-based automation, which adheres to pre-established instructions, generative AI is trained on massive datasets, continuously improving over time as it refines its outputs.

The technologies powering generative AI primarily rely on machine-learning frameworks like transformers and GANs (Generative Adversarial Networks). These frameworks enable AI systems to produce highly realistic generated data based on the available training data. Conversational AI within this context is driven by OpenAI’s advanced GPT models, which learn from extensive text datasets to provide responses that closely resemble human conversation. In finance, these models function similarly to generate market forecasts, develop investment strategies, and identify fraud patterns.

A key differentiator of generative AI is its ability to learn and create new content. Rather than merely classifying data or performing statistical analysis, it can autonomously generate financial reports, draft legal documents, and facilitate decision-making at unprecedented speeds. This level of automation is propelling businesses into a more streamlined, data-driven era.

The Role of Generative AI in Finance

Generative AI is redefining financial operations by automating complex tasks, enhancing decision-making, and improving industry efficiency.

Transforming Financial Data Management

Financial institutions rely on technology to manage vast data volumes. Generative AI enhances this capability by generating insights, forecasts, and strategies, rather than just processing data. The banking and investment sectors benefit significantly from AI-driven automation for financial modeling, fraud detection, and risk assessment. AI also enhances efficiency, reduces errors, and accelerates data-driven decision-making across financial institutions.

Automated Financial Reporting

Generative AI is revolutionizing financial reporting by automating data compilation. Instead of relying on manual efforts, AI generates detailed reports based on real-time financial data. This enhances forecasting accuracy, minimizes human error, and enables businesses to analyze trends more efficiently. Companies can leverage AI-generated reports to optimize investment strategies and gain a deeper understanding of market fluctuations, thereby improving overall financial decision-making.

Fraud Detection and Risk Assessment

Generative AI is making significant strides in fraud detection and risk assessment. AI-powered models analyze transactions in real time, identifying anomalies and potentially fraudulent activities. Traditional fraud detection systems rely on predetermined rules, which may overlook emerging fraud patterns. Generative AI, however, continuously learns from evolving threats, making it a more adaptive and efficient tool in combating financial crimes.

AI-Driven Investment Strategies

AI is transforming investment strategies by analyzing market trends, historical investments, and real-time fluctuations. Generative AI generates optimized trading strategies, allowing hedge funds and investment firms to make faster, data-driven decisions. This automation reduces reliance on human analysts, enhancing efficiency, accuracy, and risk management in financial markets while maximizing potential returns for investors and businesses.

Enhancing Customer Service with AI

Financial institutions are utilizing AI-driven automation to enhance customer service. Generative AI-powered chatbots manage inquiries, provide financial advice, and assist with banking transactions. This reduces the need for human intervention, lowering operational costs while improving efficiency. AI-driven automation enhances customer experience by delivering personalized services, faster responses, and round-the-clock assistance for banking and financial services clients.

Challenges and Ethical Considerations

As generative AI becomes more integrated into financial systems, it presents both opportunities and risks that must be carefully managed to ensure fairness, security, and accountability.

Data Bias and Reliability

While generative AI offers efficiency, data bias remains a major challenge. Since AI models learn from historical data, they may inherit and amplify biases. In finance, this can lead to biased loan approvals, inaccurate risk assessments, or unfair financial recommendations. Ensuring transparency, fairness, and regulatory compliance in AI-driven decision-making is crucial to prevent discriminatory outcomes.

AI-Generated Misinformation

Generative AI can create financial reports and predictions, but misinformation poses a risk. In volatile markets, inaccurate AI-generated reports or manipulated data can cause economic instability. Human experts must always review AI-generated financial advice to ensure accuracy, prevent manipulation, and mitigate the impact of misleading or false financial information.

Cybersecurity and AI Risks

AI handles vast amounts of sensitive financial data, making it a target for cyberattacks. Hackers could exploit AI models to generate false reports, authorize fraudulent transactions, or manipulate financial systems. Strengthening AI security measures, implementing robust monitoring, and maintaining strict data protection protocols are necessary to mitigate risks and safeguard financial integrity.

Ethical Oversight in Decision-Making

The automation of investment strategies and loan approvals raises concerns about the ethical use of AI in finance. Without human oversight, AI-driven decisions may lack accountability or fairness. Striking a balance between AI efficiency and human intervention is crucial to ensuring responsible AI use while preventing unintended financial consequences in high-stakes decision- making.

Conclusion

Generative AI is revolutionizing finance by automating financial modeling, fraud detection, and investment strategies. Its ability to generate real-time insights enhances decision-making and efficiency. However, challenges like data bias, misinformation, and security risks must be carefully managed. While AI-driven automation streamlines processes, human oversight remains essential to ensure fairness and accuracy. Financial institutions must strike a balance between leveraging AI’s capabilities and maintaining ethical responsibility. As technology evolves, the future of finance will depend on integrating AI with human expertise to create a more efficient, transparent, and secure financial landscape that benefits businesses and consumers alike.

zfn9

zfn9