PayPal isn’t usually the loudest name in tech headlines. It’s been around long enough to feel like an everyday tool—quiet, useful, reliable. But recently, something shifted. Instead of just processing payments, PayPal is now building tools that think. And not just think—they help you make smarter decisions with your money faster and with less guesswork. Their latest rollout brings AI to the front of their platform, and for once, it feels like a company built something that regular people might use without needing a tutorial.

These new AI tools are about understanding behavior, reducing the time it takes to make choices, and helping users move more clearly through their daily transactions. This isn’t about hype. It’s about getting things done better.

PayPal Rolls Out Game-Changing AI Features

A Smarter Personal Assistant in Your Pocket

The first major upgrade is an AI-driven personal finance assistant built directly into the PayPal app. This tool helps users manage their daily money habits without needing them to do much. It tracks spending behavior, sets reminders for upcoming bills, and offers savings suggestions. But it doesn’t just present raw data—it explains what’s happening and why it matters. It flags it in plain language if you’re spending more than usual or falling behind on goals. No need to tap around for answers. The AI helps users see the bigger picture while keeping their routines on track.

Helping Businesses Respond Faster and Smarter

For small businesses, PayPal now offers a messaging assistant powered by AI. It helps merchants create natural, quick replies to customer questions by learning from past conversations and picking up on context. Instead of typing out responses or hiring extra help, businesses get suggested replies that feel human and save time. It’s a practical move—these features aren’t trying to replace people; they just take the pressure off busy teams so they can focus on the parts of their work that matter most.

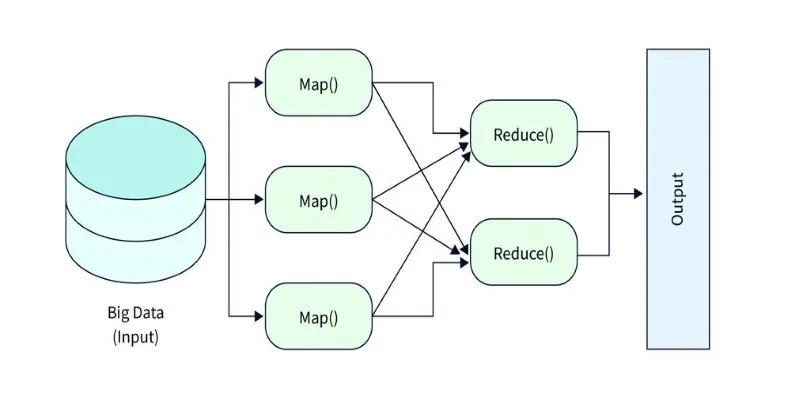

Fraud Detection That Learns

Security is one of the quiet foundations of online payments, and PayPal’s AI upgrades aim to make fraud detection smarter, not more annoying. Old fraud systems used to rely on rigid rules. The new model uses machine learning to study behavior patterns across millions of transactions and adapt them in real-time. It doesn’t just flag odd purchases—it understands buying habits and adjusts accordingly. That means fewer false alarms and better protection without the headache of declined payments for something harmless.

Clearer Data for Merchants Who Need It

The merchant dashboard has also been upgraded with AI-backed insights. Instead of scrolling through endless charts, small business owners now get a summary that tells them what they need to know: which products are selling, which aren’t, and when customers are most likely to buy. These aren’t vague analytics. They’re short, direct suggestions based on live behavior and transaction trends. Having this support for someone running an online shop with limited time and resources can help them make quicker and more confident decisions.

AI-Powered Payments That Speed Things Up

PayPal also uses AI to improve checkout with smarter, more efficient flows. If you’ve used PayPal before, the system learns your habits—like preferred shipping methods or payment types—and makes suggestions accordingly. The goal is to reduce the time and effort required to complete a transaction. These AI-powered payments adjust based on context, helping users get through checkout faster without extra clicks or confusion. It’s a small improvement that adds up, especially for repeat buyers or busy shoppers.

Opening the Door for Developers

PayPal now offers a set of AI APIs for those building on top of its systems. This gives third-party apps access tools like fraud detection, automated messaging, and behavioral analytics. Developers don’t have to start from scratch—they can plug into PayPal’s existing infrastructure and bring smarter features into their platforms. This access can help smaller companies offer competitive, intelligent tools without needing big tech budgets or in-house AI teams.

Keeping It Simple Behind the Scenes

What makes these features stand out is how invisible they are. Most of the intelligence works in the background without the user needing to activate or customize anything. The app just gets smarter as you use it. It nudges instead of interrupting. It suggests without overexplaining. This is where PayPal’s long experience helps—it already knows the patterns of online payments at a massive scale. Now, that experience is powering a system that doesn’t just process transactions but understands them in context.

An Approach That Doesn’t Add Noise

There’s no shortage of platforms trying to incorporate AI into every corner of the user experience. But PayPal’s rollout avoids the trap of turning AI into a gimmick. These tools don’t shout for attention. They just work, making them more accessible to everyday users, not just the tech-savvy ones. Whether someone is sending money to a friend, managing a side hustle, or tracking monthly bills, these tools help without forcing change.

Smart Dispute Resolution Support

PayPal’s AI now supports faster dispute resolution by guiding users through the process with smart prompts. It identifies the issue type, fills in key transaction details, and offers real-time updates. Sellers get suggestions on how to respond with the right evidence. This helps both sides resolve issues more efficiently, reducing confusion and delays. The claims process becomes clearer, smoother, and less stressful for everyone involved.

Conclusion

PayPal’s new AI features weren’t designed to impress—they were built to make daily money tasks easier. They reduce friction, help users make smarter choices, and save businesses time. Whether you’re sending payments, managing a small business, or keeping an eye on your bills, the goal stays the same: less confusion, fewer steps, and more clarity. These PayPal AI features don’t try to dazzle—they just do the work. And that’s what makes them worth paying attention to. In a world full of loud tech rollouts, PayPal’s quiet upgrade might be the one that sticks.

For more insights on digital payments and AI, check out this article from PayPal’s newsroom.

zfn9

zfn9