Artificial Intelligence (AI) is revolutionizing industries worldwide, and the finance sector is no exception. However, despite real progress, there’s also a lot of confusion. People often hear about AI making trading decisions, approving loans, or detecting fraud and assume it’s either a miracle tool or a job-destroying force. The truth lies somewhere in between.

While AI has significantly changed how financial services operate, many misconceptions still surround its actual role. This post uncovers the reality behind AI in finance by clearing up common myths and highlighting how this technology is being practically applied today.

What Is AI in Finance?

In finance, AI refers to the use of smart algorithms and machine learning tools to analyze data, streamline tasks, and assist in decision-making. These tools can identify patterns, learn from data, and even adapt to new information without needing to be reprogrammed.

Common areas where AI is already being used include:

- Fraud detection and prevention

- Risk evaluation for loans and credit

- Personalized financial services

- Trading and investment decisions

- Customer support automation

AI is not a single machine or system. Instead, it encompasses a variety of technologies, such as natural language processing, predictive analytics, and robotic process automation.

Myth #1: AI Will Replace Humans in Finance

One of the biggest myths about AI in banking is that machines will take over all human jobs. While automation can handle repetitive or rule-based tasks, it lacks the emotional intelligence and moral reasoning that finance professionals possess.

Reality : AI is being used to support humans, not replace them. For example, AI can analyze thousands of financial reports in seconds, but human analysts are still needed to interpret the findings, consider market context, and communicate insights to clients. Financial advisors, relationship managers, and risk officers continue to play a central role.

Myth #2: AI Is Always Right

Another false belief is that AI systems are flawless and free from error. Many assume that since AI uses data and logic, it must always make the best decisions.

Reality : AI is only as good as the data it receives. If the input data is biased, outdated, or incomplete, the system may generate inaccurate predictions. For instance, if an AI model is trained on data that favors certain income groups for loan approvals, it may end up reinforcing unfair practices. Human oversight is essential to spot these issues and adjust the model accordingly.

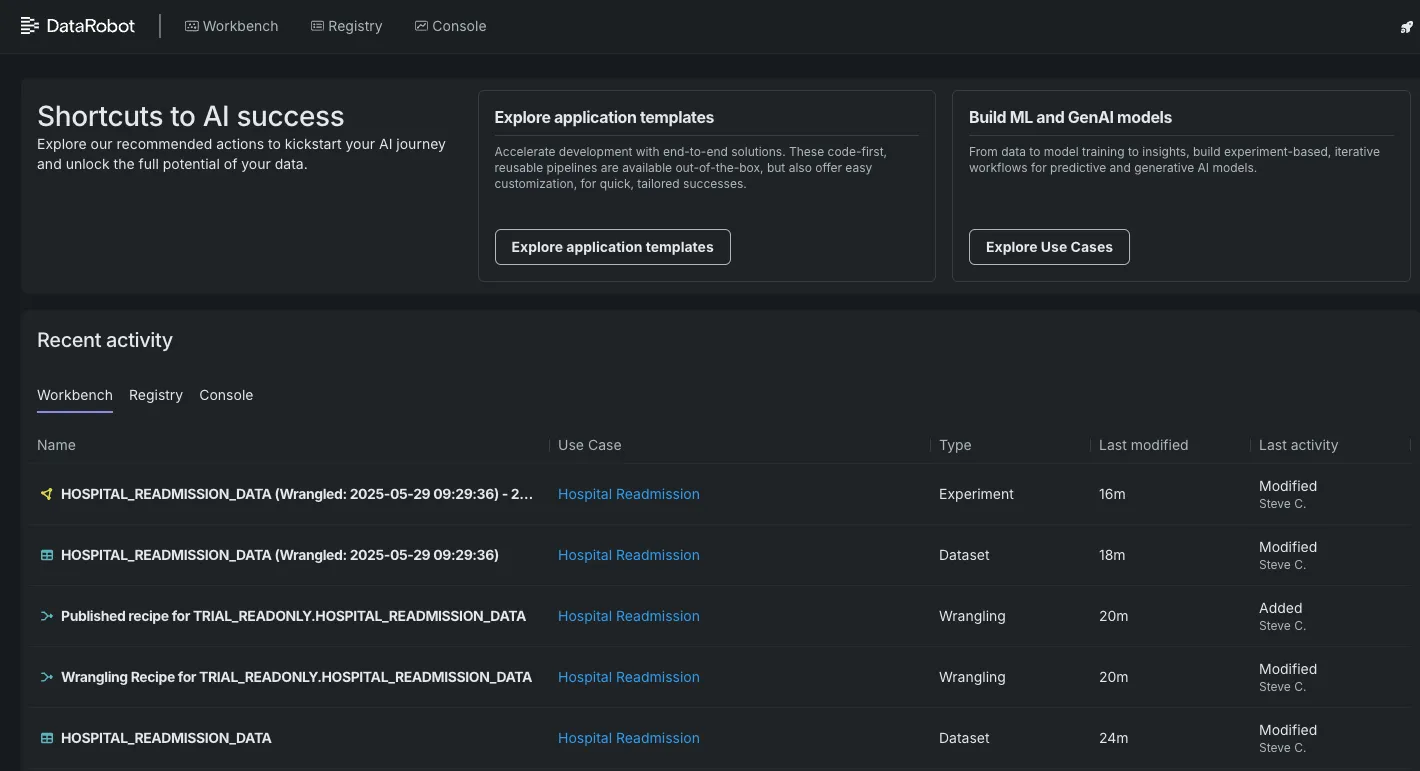

Myth #3: Only Big Financial Institutions Use AI

Some people think that only large banks or hedge funds can afford or benefit from AI technology. This idea has discouraged smaller businesses and individual advisors from exploring its advantages.

Reality : AI tools have become more accessible thanks to cloud computing and software-as-a-service platforms. Many fintech startups, small accounting firms, and independent financial planners are now using AI for tasks like budgeting automation, customer communication, and data analysis. It’s no longer a technology reserved for the elite.

Misconceptions That Create Fear

Along with myths, several misconceptions slow down the acceptance of AI in financial services.

Misconception #1: AI Can Understand Human Emotions and Context

AI can process data at incredible speeds, but it does not understand the “why” behind human behavior. In finance, emotional reactions to events—like fear- driven market selloffs or political news—play a big role. AI systems may notice a sudden drop in stock prices but can’t grasp the emotional panic behind it. Human judgment is still needed to add meaning and interpretation to AI outputs.

Misconception #2: Once Set Up, AI Can Run Itself

Some believe that after an AI system is built, it can operate on autopilot with little to no maintenance. This is far from true. AI systems require regular updates, constant monitoring, and frequent fine-tuning to remain effective. Without supervision, an AI tool could drift from its original goal or become unreliable over time.

The Real-World Role of AI in Finance

Beyond the noise and confusion, AI is being used in many practical and impactful ways within the financial sector.

Risk Management and Fraud Detection

AI systems can identify suspicious activity and prevent fraud in real time. They monitor patterns of behavior and flag anything unusual, allowing banks and institutions to act before damage occurs.

- Flagging high-risk transactions

- Predicting potential loan defaults

- Detecting identity theft

These systems help institutions avoid losses and protect customer data.

Customer Support and Experience

Chatbots and virtual assistants powered by AI are now handling basic customer service tasks. They can answer FAQs, check account balances, and even assist with transactions—all available 24/7.

Investment Strategy and Algorithmic Trading

AI helps investors make smarter decisions by analyzing large volumes of market data. Machine learning models can identify market trends, predict future stock prices, and execute trades automatically based on set rules.

- Faster decision-making

- Reduced emotional trading

- Improved portfolio performance

Still, most financial firms use AI alongside human traders, not as a replacement.

Benefits of AI in Financial Services

When used correctly, AI offers significant value across the industry:

- Speed : Processes that took hours now happen in seconds.

- Accuracy : Automated systems reduce manual errors.

- Efficiency : Repetitive tasks are handled by AI, freeing humans for higher-level work.

- Security : AI enhances fraud detection and data protection.

- Customization : Clients receive more personalized advice and services.

These benefits are helping financial companies remain competitive in a fast- moving digital landscape.

Conclusion

AI in finance is a powerful tool, but it is not a magical solution. It plays a key role in automating tasks, minimizing errors, and improving overall efficiency. However, human expertise remains essential for oversight, ethical decision-making, and understanding the context that machines cannot grasp. The idea that AI will fully replace financial professionals or deliver perfect results is simply a myth. In reality, AI is most effective when used alongside human intelligence.

zfn9

zfn9