For those unfamiliar with the profession, an actuary’s work might seem enigmatic, yet it stands as one of the most vital roles in the financial sector. By leveraging mathematics, statistics, and data, actuaries assist businesses and governments in understanding and managing risk. Whether it involves setting insurance premiums, calculating pension obligations, or predicting future financial outcomes, actuaries are the experts behind the numbers that drive critical decisions.

As businesses increasingly rely on data, the role of an actuary is evolving. If you seek a career that combines analytical talent with practical application, becoming an actuary could be the ideal choice.

The Role of an Actuary

An actuary’s primary responsibility is to analyze financial uncertainties and risks using mathematics, statistics, and data modeling methods. They collect data, develop models to forecast future events, and apply this knowledge to guide decisions in areas like insurance premiums, pension schemes, and investment plans.

For instance, an actuary working for an insurance company might use data to calculate the probability of a policyholder making a claim. With this probability, they can set premiums that accurately reflect the risk associated with insuring that individual or group. Additionally, actuaries assist pension funds in determining the amount of money to save today to meet future pension liabilities.

Actuaries also engage in product development, helping firms create new financial products or services based on risk analysis. They ensure that companies can offer competitive yet sustainable products. Moreover, actuaries help businesses comply with regulatory requirements, ensuring financial estimates are realistic and firms have adequate reserves to handle potential liabilities.

Key Skills and Education Required

Becoming an actuary requires specific skills and qualifications, including a strong foundation in mathematics and statistics. Actuaries must be adept at analyzing complex data, interpreting results, and communicating insights effectively. Problem-solving and critical thinking are central to their work, as they frequently encounter challenges that require innovative solutions.

Educationally, aspiring actuaries typically hold degrees in mathematics, statistics, economics, or related fields. Many pursue specialized certifications, such as the Associate or Fellow designation, from professional organizations like the Society of Actuaries (SOA) or the Casualty Actuarial Society (CAS). These certifications often necessitate passing a series of exams that evaluate a candidate’s proficiency in various actuarial techniques and concepts.

In addition to technical expertise, communication skills are essential for actuaries. They must convey complex data findings to non-experts, such as managers, clients, or government regulators. The ability to present data clearly and effectively can be as crucial as the analysis itself.

Day-to-Day Responsibilities of an Actuary

An actuary’s daily tasks vary depending on their industry, but there are common elements across the profession. On any given day, actuaries may engage in activities such as:

Data Collection and Analysis: Actuaries gather, clean, and verify data from various sources, including financial records and census data, ensuring accuracy before analysis to support risk assessment and forecasting.

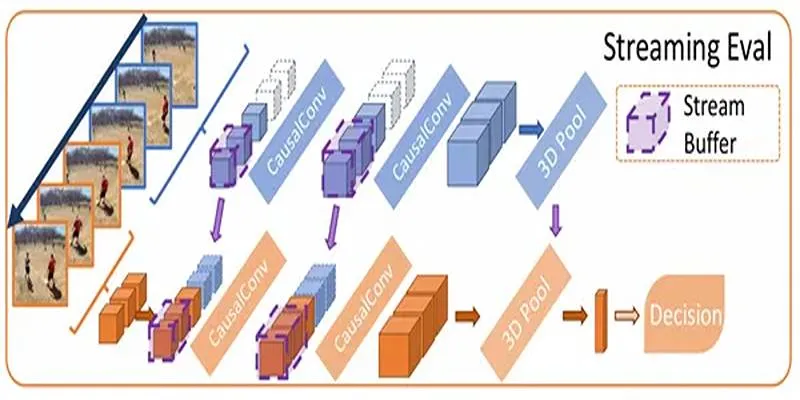

Building and Refining Models: Using programming languages like Python and R, actuaries develop predictive models to assess risks, forecast trends, and assist businesses in making informed decisions on financial planning and risk management.

Providing Recommendations: After analyzing data, actuaries collaborate with teams to advise on premium rates, insurance structures, and financial strategies to minimize risks and optimize profitability for businesses and clients.

Monitoring and Adjusting: Actuaries continuously refine models based on real-world data, improving accuracy by updating predictions and adjusting risk assessments as economic conditions and industry trends evolve.

Reporting and Communicating Results: Actuaries present findings to stakeholders, translating complex data insights into actionable strategies that influence financial planning, regulatory compliance, and corporate decision-making.

Career Opportunities and Job Outlook in 2025

The demand for actuaries remains robust and is expected to continue growing into 2025 and beyond. As businesses confront increasingly complex challenges, actuaries play a critical role in risk management, financial planning, and data analysis across various industries. While the insurance sector remains the largest employer of actuaries, other fields such as healthcare, pension funds, government agencies, and technology companies also heavily rely on actuarial expertise.

In healthcare, actuaries price health insurance plans, evaluate the financial stability of healthcare systems, and analyze the costs associated with new medical treatments. The integration of big data, machine learning, and artificial intelligence (AI) is revolutionizing the actuarial profession. These technologies provide actuaries with vast amounts of data, enabling them to build more precise models and improve decision-making processes.

Data science and AI skills are becoming increasingly important for actuaries as these technologies enhance their ability to analyze and interpret complex data. Future actuarial work will likely involve closer collaboration with data scientists to uncover insights from large datasets.

The U.S. Bureau of Labor Statistics projects that employment for actuaries will grow by 18% from 2022 to 2032, significantly outpacing the average growth rate for all occupations. This growth is driven by the increasing need for actuaries to manage financial risks in industries such as insurance, healthcare, and finance. As these sectors continue to evolve, the demand for skilled actuaries will remain strong, offering promising career opportunities in the years ahead.

Conclusion

The role of an actuary is both challenging and rewarding, offering a unique blend of analytical work and real-world impact. As industries continue to rely on data-driven decisions, the demand for skilled actuaries will grow significantly. With a solid educational background, specialized certifications, strong problem-solving skills, and the ability to adapt to emerging technologies, actuaries will remain essential in managing risk and shaping the future of finance. It’s a dynamic career that promises growth, opportunity, and a lasting impact on various industries worldwide.

zfn9

zfn9