Artificial intelligence (AI) is increasingly integral to modern business, and the financial industry is no exception. AI is transforming traditional finance roles by automating tasks and predicting financial trends, setting new standards for industry professionals.

To remain valuable and relevant, finance employees must acquire specific AI- related skills. This doesn’t mean turning every financial analyst into a data scientist, but equipping them with the tools and understanding necessary to thrive in a tech-driven world.

Why AI Skills Are Now a Must-Have in Finance

Historically, finance roles focused on number crunching, spreadsheets, and compliance. Today, automation handles much of the routine work, allowing professionals to concentrate on analysis and strategic planning. AI delivers insights with greater speed and accuracy.

However, simply using AI tools is no longer enough. Employers now expect finance professionals to comprehend how these tools work, interpret results, and make data-driven decisions confidently. Without AI literacy, finance employees risk falling behind in both performance and career progression.

Key AI Skills Every Finance Professional Should Master

Understanding AI Fundamentals

Before diving into AI applications, finance professionals need to grasp the basics. Key concepts include:

- Understanding machine learning and its differences from traditional programming

- How algorithms detect patterns and make predictions

- The distinctions between supervised and unsupervised learning

- The importance of data quality in AI models

Even a foundational understanding enables finance employees to ask better questions, communicate more effectively with technical teams, and contribute meaningfully to AI-powered projects.

Data Literacy and Interpretation

AI relies heavily on data. A finance professional who can’t work with data will struggle to work with AI. Data literacy includes:

- Understanding data sources (internal systems, market feeds, etc.)

- Identifying errors or gaps in datasets

- Interpreting trends and visualizations in AI dashboards

- Evaluating if the output of a model makes sense in a financial context

For example, if an AI tool forecasts a sharp decline in quarterly revenue, it’s up to the finance team to verify the inputs and assess if external factors—like seasonality or market shifts—have been properly considered.

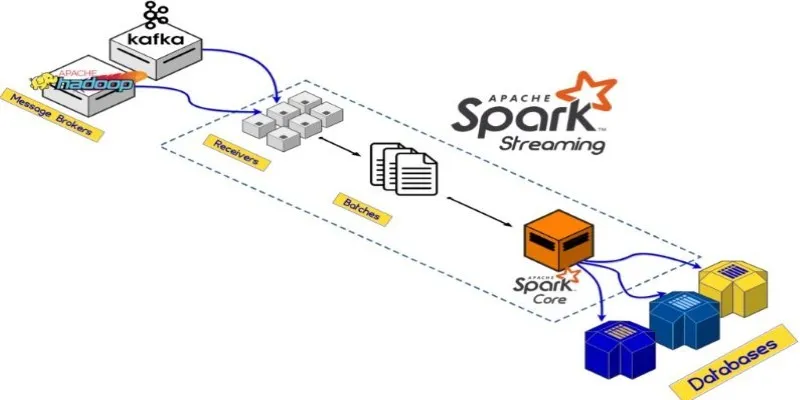

Using Automation Tools in Financial Workflows

AI-powered automation tools are becoming standard in many finance departments. Employees are expected to know how to operate tools that streamline tasks, such as:

- Invoice processing

- Bank reconciliation

- Expense report approvals

- Budget tracking and reporting

Automation platforms like UiPath, Alteryx, and Microsoft Power Automate are already widely adopted. While coding isn’t required, finance professionals must understand how to use these tools and configure basic automation rules.

Working with Predictive Analytics

Forecasting is a major part of finance. With AI, forecasting is now more data- driven and precise. Finance employees need to learn how to:

- Interpret AI-generated forecasts

- Understand the logic behind predictive models

- Spot signs of overfitting or bias in model outcomes

- Present forecasts clearly to stakeholders

For instance, a predictive model might suggest reducing inventory due to expected lower sales. Finance professionals must validate this with broader market analysis and ensure the business isn’t reacting to an inaccurate prediction.

Soft Skills That Complement AI Knowledge

While technical skills are essential, they work best when paired with the right soft skills. Finance professionals should develop the following:

- Critical thinking – to challenge AI predictions and avoid blind reliance on tools

- Adaptability – to learn new tools quickly as AI continues to evolve

- Communication – to explain AI-generated insights to non-technical stakeholders

- Problem-solving – to identify where AI can add value to daily workflows

AI doesn’t replace finance professionals—it empowers those who are ready to grow with it.

How Finance Employees Can Start Building AI Skills

The good news is that AI skills are accessible. Finance professionals can start building their knowledge through the following:

- Online courses on platforms like Coursera, edX, and LinkedIn Learning

- In-house upskilling programs offered by forward-thinking finance teams

- YouTube channels that explain AI and automation tools in a simple way

- Finance-tech blogs that discuss real AI use cases

Here are some actionable steps:

- Begin with an introduction to AI course tailored to business or finance

- Follow finance influencers and AI experts on LinkedIn for insights

- Experiment with free AI tools or dashboards to get hands-on experience

- Join communities or forums where finance and tech professionals share use cases

Starting with small steps helps build confidence and leads to deeper learning.

Benefits of AI Skills for Finance Professionals

Developing AI skills isn’t just about staying employed—it’s about staying ahead. Finance professionals with AI skills can:

- Make better decisions backed by real-time data

- Automate repetitive work and focus on strategic analysis

- Contribute to innovation in budgeting, forecasting, and risk management

- Future-proof their careers in an evolving industry

Companies actively seek finance employees who bring both domain expertise and tech-savviness to the table.

Key AI Tools Every Finance Professional Should Know

It helps to get familiar with tools already used in the finance world. These include:

- Power BI or Tableau – for visualizing financial data

- Alteryx – for automating data prep and blending

- QuickBooks/Xero – AI-powered accounting tools

- ChatGPT or Copilot – for automating writing tasks like emails or financial summaries

- Microsoft Excel (with AI add-ins) – for everyday reporting and analysis

Conclusion

In today’s fast-moving world, finance employees can’t afford to ignore the rise of artificial intelligence. Developing AI skills doesn’t mean becoming a programmer—it means understanding how these tools work, how to use them wisely, and how to make informed decisions with the results. The most successful finance professionals of tomorrow will be those who combine their financial expertise with smart, relevant AI skills today.

zfn9

zfn9